Whilst it has been a challenging year overall for the EV industry, there have also been developments and significant progress for both vehicle uptake and the UK’s charging infrastructure.

July heralded the start of a new Labour Government, and with it a commitment to restoring the 2030 ban on the sale of new petrol and diesel cars. In November, the ZEV Mandate came into effect, setting out the increasing percentage of new zero emission cars and vans that manufacturers will be required to sell each year up to 2030.

After two years of static EV market share, in 2024 this increased to 19.6%, with more than 380,000 new EVs vehicles sold, bringing the overall EV car parc to 1.36m*. This reflects increasing confidence in the benefits of electric vehicles, the robustness of the charging infrastructure, and also the impact that the ZEV mandate is beginning to have.

In parallel, the charging infrastructure has been rolled out at a record rate through 2024, with high growth across all areas from en-route, through to destination and on-street charging.

Satisfaction from existing EV drivers remains high, with feedback from Zapmap app users showing that the average level of satisfaction has grown to 87%. Confidence in the charging infrastructure has also grown with 61% saying that it has improved, but there is still room for improvement on the consumer experience.

As 2024 draws to a close, we pause to take stock and consider what 2025 has in store for EV drivers with regard to EV charging.

More hubs and ultra-rapid devices

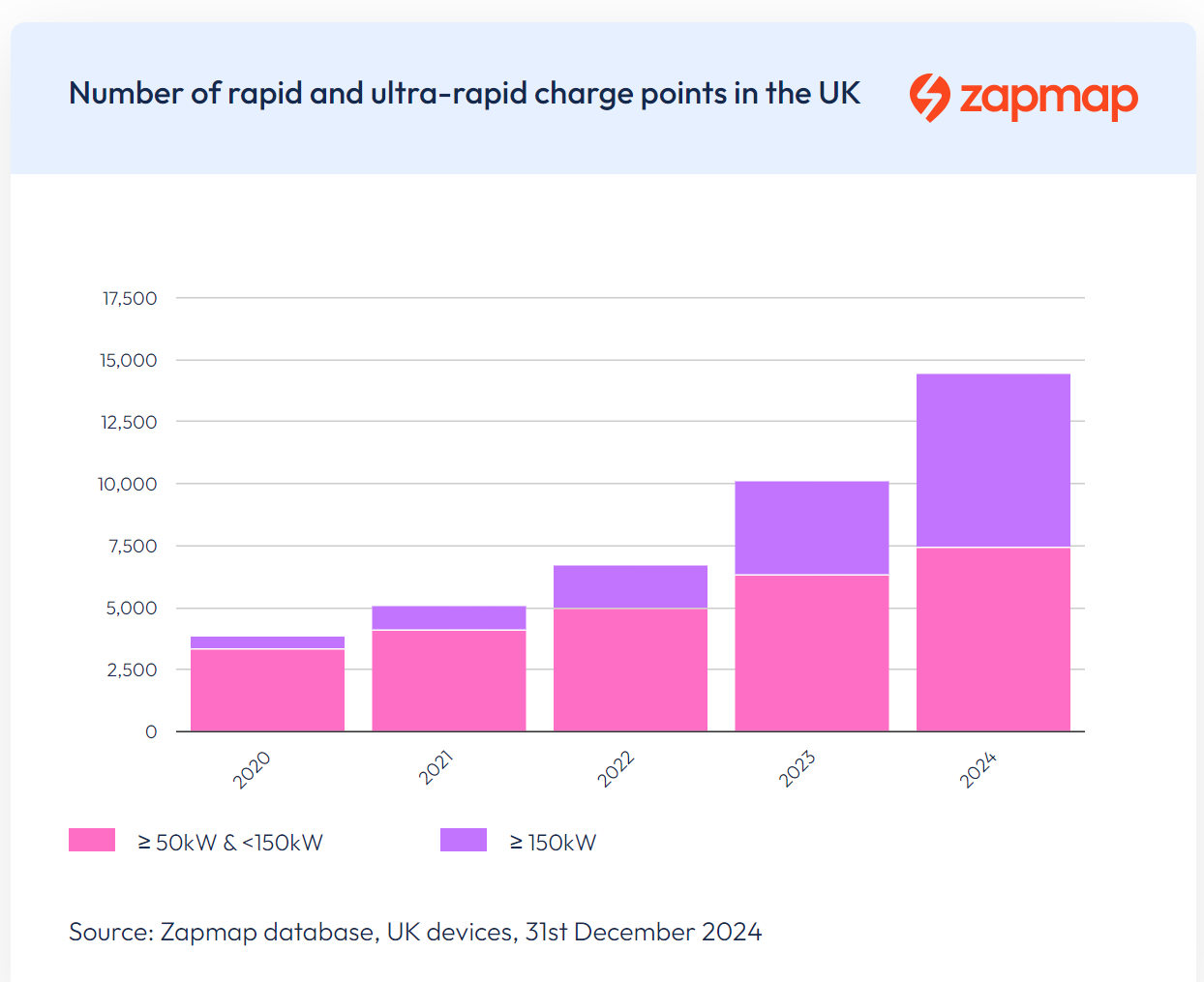

Ultra-rapid devices (150kW+), the fastest charge points designed to support EV drivers on longer journeys, showed the most growth in 2024 with 84% year on year growth — Jade Edwards, Head of Insights at Zapmap predicts that we can expect to see that growth continue into 2025.

“Those charge point operators (CPOs) catering to en-route and quick top-up charging needs are increasingly opting to install devices that are delivering at least 150kW,” says Edwards.

“At the end of 2024 there are more than 7,000 ultra-rapid charge points, and we can expect that number to exceed 10,000 during 2025.

Rapid devices: 7,450, ultra-rapid devices: 7,021 as of December 2024

“In parallel, the quantity and usage of EV charging hubs has grown strongly in each of the last four years with 53% of drivers reporting using them. We can expect to see more of these rolling out in the coming year along with Tesla opening up more of its charging locations to the public.”

LEVI funded local charging starting to rollout

For slower on-street charging, needed to support those households without access to a driveway, we’ll begin to see the Local EV Infrastructure (LEVI) funds hitting the streets throughout 2025, with Local Authorities around the country working with CPOs to enhance their near-home public charging offering.

“These projects will result in thousands of additional charge points and most importantly will begin to address the current disparity of provision at a local level,” says Edwards.

Action on the cost of charging

"The cost of charging for the majority of EV drivers remains significantly cheaper than running an ICE vehicle,” says Melanie Shufflebotham, Co-founder and COO at Zapmap.

“But for those charging solely on the public network, costs are a concern.”

As highlighted by Charge UK, standing charges for CPOs have increased dramatically over the past couple of years, limiting their ability to bring down public charging costs. Meanwhile, organisations such as FairCharge are highlighting the higher VAT rates on electricity for those who cannot charge at home.

“We can expect to see further discussion around these imbalances in 2025 and the beginning of measures to make EV ownership more equitable."

Charging infrastructure has been rolled out at a record rate through 2024, with high growth across all areas from en-route, through to destination and on-street charging.

More charging data available

“All CPOs will be making sure that they are implementing and fully compliant with the latest government PCPR regulations that came into force on the 24th November," says Matt Lloyd, Head of CPO Networks, Zapmap.

Public Charge Point Regulations (PCPR) may have been introduced in 2023, with the goal of boosting confidence in the public charging network, but many of the regulations are only now coming into effect, with additional stipulations coming into force over the next twelve months.

From November 2024 all CPOs must publish static and dynamic data for each charge point within their network via the Open Charge Point Interface (OCPI). CPOs will also need to collate reliability data throughout 2025 in order to report it in January 2026 and, by November 2025, they will need to connect to at least one roaming provider, which will go some way towards allowing drivers to charge using their chosen payment method.

Zapmap continues work with most of the CPOs in the country to bring different elements of PCPR to life.

"This change in the way data is handled will provide some benefits to EV drivers," says Edwards, "but we can also expect to see changes in the way that industry players utilise data — both their own and that of their competitors — in their decision making and future planning."

"Within Zapmap Insights we now have access to more granular data and insights on charge point utilisation and reliability than ever before, which can be used to support CPOs and the wider industry," adds Edwards.

"CPOs will for the first time be able to use competitor utilisation data from existing sites to help with their site planning decisions, as well as enabling deeper insights into performance (utilisation and reliability) versus key competitors and the wider market."

We finally reach the point of ‘peak CPO’

"We may have finally come to the point of peak CPO," continues Lloyd. "With over 80 CPOs currently in the market, it seems unlikely that the market will accommodate new entrants, unless they have a pre-existing competitive advantage, such as an established network in another European county or access to real estate. Such new CPOs would need to be well capitalised to enable them to embed themselves quickly."

The quantity and usage of EV charging hubs has grown strongly in each of the last four years with 53% of drivers reporting using them.

A confident and well supported driver community

While charge point operators work to improve the charging experience for drivers, and industry bodies flag issues of fairness and accessibility, Ed Walsh, Head of Product at Zapmap, continues to focus on delivering products and services that evolve with the acceleration of EV uptake.

"Our focus is on serving two key groups," says Walsh. "Firstly, those who have already made the switch to electric, many of whom are now looking to optimise their experience, lower the cost of ownership, and feel rewarded for making cleaner and greener choices to minimise their footprint."

"The second group is those who haven't yet made the switch, possibly due to a lack of confidence, appropriately priced vehicles, or because they feel underserved by the charging solutions that exist today. These include those without driveways or near home charging, alongside those with accessibility needs or different sized vehicles."

At Zapmap, we remain focused on serving our core audience; those who regularly make use of the public network. But we're also expanding our service to ensure those who only occasionally charge in public can access a more joined up home and away charging service through our partnership with Hive. We’ll continue to tackle perceived barriers and real pain points as we simplify payments through easy to use digital and RFID solutions, also expanding our services via further partnerships to meet needs of those underserved and less confident drivers.

"We're proud of the role we've played in helping people understand and access great public charging,” says Walsh, “and now our focus is on ensuring our services reward drivers, giving them a compelling reason to return and use us whenever they charge.

"Through the strategic partnerships we're building, development of our own payment and rewards services, and development of our partner promotions, we're building a rich ecosystem that will truly reward drivers for making the great choice to go electric."

More education and less misinformation

“To continue the momentum in 2025, the industry needs certainty from the legislation, continued focus on the consumer experience and a combined effort from both industry and government to get clear facts out into the market, so that the next 5 million drivers have the confidence to make the switch,” says Shufflebotham.

“Last year there was a steady stream of negative commentary from anti-EV media outlets, which has had an impact on consumer sentiment. Whilst there are many organisations providing information already, we expect that in 2025 there will be a more co-ordinated effort to get the facts on the reality of EVs and charging out into the market.”

“Zapmap will continue to provide regular information on the growth and composition of the charging market, and guides for EV drivers and third party collaborations. We will also o support wider efforts across Government and new initiatives such as ElectricVehiclesUK.”

Accelerated growth will lead to radical innovation

"2024 has been one of solid progress, in terms of EV adoption, infrastructure developments and public-private collaboration," observes Richard Bourne, CEO of Zapmap.

"We’re now moving into a new phase of more mainstream EV adoption and with that, we’re likely to see an increase in partnerships to enable industry players to enhance their capabilities and expand market reach. We may begin to see consolidation. More excitingly, new innovations will start coming through, both in terms of placing EVs at the heart of the wider sustainable energy ecosystem, and of ensuring accessibility for all.

"As the EV driver community grows, and the industry matures, at Zapmap we continue to focus on ensuring that EV charging is as simple as possible, while delivering on our commercial partnerships and our commitment to the robustness and accuracy of our data. We’re all set for another exciting year in 2025."

*Figure to end Jan 2025 - Article updated to reflect data at end of December 2024